Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

equity

27 Sep 2019

Achievement of Purposes

People use the financial system for various reasons, which can be broken down into six main purposes. However, regardless of the purpose, the financial system is more efficient when transactions are performed in liquid markets.

Saving

Both individuals and companies set aside money in the present to have more to spend in the future. Individuals typically save during their working years so they can withdraw money later on to fund their retirement. Corporations may save money collected from customers to repay suppliers or lenders, purchase new equipment, or acquire other companies. Money can be saved in a broad range of investment vehicles: from low-risk treasury bills to higher-risk corporate bonds and stocks. Investors who put money into riskier investments expect to be compensated with higher returns.

Borrowing

Borrowing means getting money now and repaying it later. Borrowers might use secured loans, such as car loans and mortgages. If they don’t repay, the lender can sell the collateral. On the other hand, student loans or credit card debt is typically unsecured. Since there is no collateral to be recovered if the borrower fails to pay, lenders will typically charge a higher interest rate on unsecured loans to compensate for the greater downside risk. In addition, companies oftentimes utilize both debt and equity to fund current and future investments. Finally, governments borrow money to fund current spending. They do this by issuing bills, notes, and loans that will be repaid using future taxes or revenue from government projects.

Raising Equity Capital

Companies work with investment banks to raise equity capital, where investors buy shares of the company in exchange for cash. These shares don’t guarantee fixed future payments, but investors expect dividends or capital gains. Analysts help assess the value of company shares, and regulations and accounting standards ensure transparency in financial statements.

Managing Risks

To manage risks, investors use forward contracts, futures contracts, options contracts, insurance contracts, and other derivatives. These contracts serve to offset the effect of adverse price movements in assets that a party may need to buy or sell in the future. For example, an airline may enter into a forward contract to buy jet fuel at a certain price on some fixed date in the future, hedging the risk of rising prices. The party on the other side of the trade may be the fuel supplier, hedging the risk of falling prices. While their risks are opposite, both parties achieve their purposes with a single transaction.

Exchanging Assets for Immediate Delivery (Spot Market Trading)

People and companies use the spot market to trade a currency to acquire other currencies or commodities, which will be delivered immediately when the transaction occurs.

Information-Motivated Trading

Investors and information-motivated traders both aim to buy low and sell high. However, information-motivated traders expect extra profits because of their information advantage. They believe they can identify undervalued and overvalued companies, making money when share prices align with the companies’ true value.

Active investment managers participate in information-motivated trading to beat their benchmark or the return earned by “buy and hold” investors taking similar risks. In theory, active managers can gain an information edge over other market participants by hiring skilled professionals and conducting thorough research on potential investments. Investors are also information-motivated traders when they allocate funds with the expectation of earning conditional returns greater than the unconditional returns they would earn in the same asset class.

Determining Appropriate Rates of Return

Since savers are on the opposite end of transactions with borrowers and equity sellers, the rate of return must be set at the point where both parties are satisfied. The cost of moving money through time, or the equilibrium interest rate, is the rate at which aggregate supply for funds through savings equals aggregate demand. Savers won’t supply capital if too low of a rate is offered, and borrowers won’t demand capital if too high of a rate is offered. To determine the rate of return, the equilibrium interest rate must be adjusted depending on the risk characteristics, terms, and liquidity of the security.

Efficient Capital Allocation

Efficient capital allocation allows the market’s scarce capital to be allocated to only the most productive investments. A market is efficient when market participants have access to accurate information. When investors are thorough in their analysis of available information, they improve the efficiency of the market by simply acting in their own best interests. For example, well-informed investors will not extend a loan to someone with a poor credit rating without being appropriately compensated with a higher rate of return. At the same time, they will not invest in projects unless the value of future cash flows exceeds the cost.

Question

As the portfolio manager of an equity fund, you decide to allocate a percentage of the fund’s capital to invest in the common stock of ABC after its share price plummeted on lower-than-expected earnings. You believe that ABC’s stock is currently undervalued due to an overreaction of the market to the earnings announcement. In this instance, you were using the financial system for:

- Saving.

- Managing Risk.

- Information-Motivated Trading.

Solution

The correct answer is C.

You were acting as an information-motivated trader because you traded with the intention of earning excess profit from information that had not been priced into the market.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Sergio Torrico

2021-07-23

Excelente para el FRM 2Escribo esta revisión en español para los hispanohablantes, soy de Bolivia, y utilicé AnalystPrep para dudas y consultas sobre mi preparación para el FRM nivel 2 (lo tomé una sola vez y aprobé muy bien), siempre tuve un soporte claro, directo y rápido, el material sale rápido cuando hay cambios en el temario de GARP, y los ejercicios y exámenes son muy útiles para practicar.

diana

2021-07-17

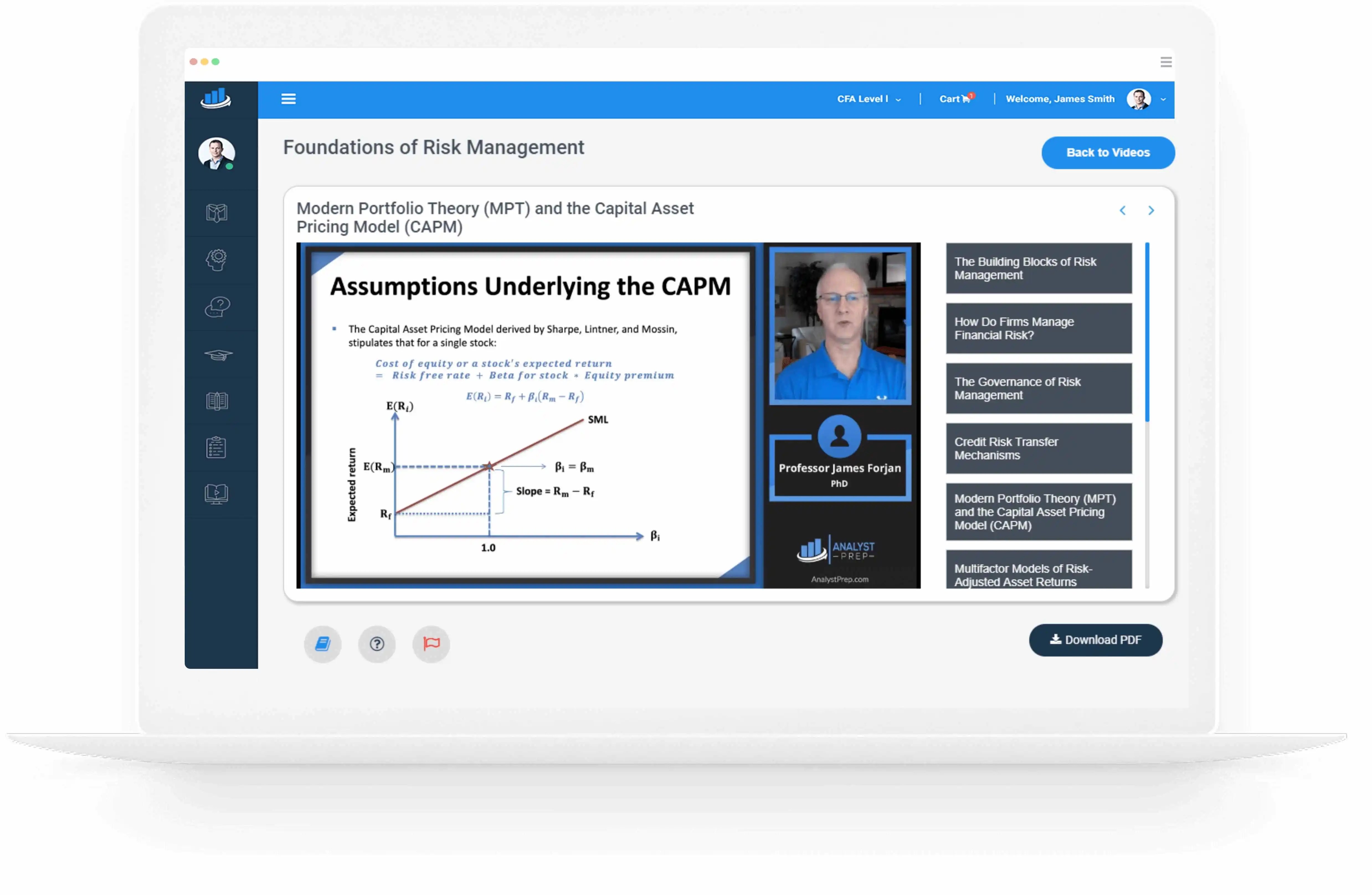

So helpful. I have been using the videos to prepare for the CFA Level II exam. The videos signpost the reading contents, explain the concepts and provide additional context for specific concepts. The fun light-hearted analogies are also a welcome break to some very dry content.I usually watch the videos before going into more in-depth reading and they are a good way to avoid being overwhelmed by the sheer volume of content when you look at the readings.

Kriti Dhawan

2021-07-16

A great curriculum provider. James sir explains the concept so well that rather than memorising it, you tend to intuitively understand and absorb them. Thank you ! Grateful I saw this at the right time for my CFA prep.

nikhil kumar

2021-06-28

Very well explained and gives a great insight about topics in a very short time. Glad to have found Professor Forjan's lectures.

Marwan

2021-06-22

Great support throughout the course by the team, did not feel neglected

Benjamin anonymous

2021-05-10

I loved using AnalystPrep for FRM. QBank is huge, videos are great. Would recommend to a friend

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Trustpilot rating score: 4.5 of 5, based on 69 reviews.

Related Posts