Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

financial-reporting-and-analysis

08 Oct 2019

The Conceptual Framework for Financial Reporting (2010) provides important information on the concepts which underlie the preparation and presentation of financial statements. This framework is of great benefit to all financial statement users. It has several components that are outlined in figure 1 below.

Outline of the IASB Conceptual Framework

Figure 1 – IFRS Framework for the Preparation and Presentation of Financial Reports

Main Objective of the Conceptual Framework

The Conceptual Framework (2010) has a core objective from which all its other aspects flow. This central objective is “to provide financial information which is useful to both current and potential providers of resources (investors, lenders, other creditors) in decision-making.“

The financial information to be provided will include: (i) information on a company’s financial position (its resources and financial obligations); (ii) information on a company’s financial performance (information which explains why the company’s financial position changed in the past); and (iii) information on the company’s cash and cash equivalents.

Qualitative Characteristics

The Conceptual Framework (2010) identifies relevance and faithful representation as the two fundamental qualitative characteristics which make financial information useful. Financial information is relevant if it would potentially affect or make a difference in its consumer’s decision. Faithful representation relates to the fact that information that represents an economic phenomenon should ideally be complete, neutral, and free from error.

The Conceptual Framework (2010) also identifies comparability, verifiability, timeliness, and understandability as the four enhancing qualitative characteristics of information:

- comparability permits the identification and understanding of similarities and differences between items of information;

- verifiability means that different observers would independently agree that the information that is presented faithfully represents the economic phenomena that it alleges to represent;

- timeliness refers to the availability of information to decision makers when it is needed i.e. before the need for decision-making arises; and

- understandability means that the information should be comprehensible to its users who have a reasonable knowledge of business and economic activities, and are willing to diligently study it.

Constraints on Financial Reports

The cost of providing and using financial information is a constraint that must be balanced with the benefits that are to be derived from the information.

Elements of Financial Statements

The financial effects of transactions and other events are represented in financial statements by grouping them into broad classes or elements. The grouping is done according to their economic characteristics.

The elements of financial statements that are directly related to financial positions are assets, liabilities, and equity. The elements directly related to financial performance, on the other hand, are income and expenses.

Accrual accounting and ‘going concern’ are two key assumptions that underlie the preparation of financial statements. These assumptions determine how financial statement elements are recognized and measured. Accrual accounting means that financial statements reflect transactions in the period in which they occur and not necessarily when cash movement occurs. ‘Going concern’ means that a company is assumed to continue in business for the foreseeable future.

Recognition refers to the inclusion of an item on the balance sheet or income statement. An item should be recognized if it is probable that future economic benefits that are associated with it will flow to or from the reporting entity, and it has a cost or value that can be reliably measured.

In measuring financial statement elements, the following bases of measurement may be used:

- historical cost: this refers to the amount of cash or cash equivalents paid or the fair value of what was given to purchase an asset. Concerning liabilities, it refers to the amount of proceeds received in exchange for an obligation;

- amortized cost: this refers to the historical cost after adjustments are made for amortization, depreciation, depletion, and/or impairment;

- current cost: concerning assets, this refers to the amount of cash or cash equivalents that would have to be paid to purchase the same or an equivalent asset today. Concerning liabilities, the current cost refers to the undiscounted amount of cash or cash equivalents that are required to settle the obligation today;

- realizable (settlement) value: realizable value refers to the amount of cash or cash equivalents that could currently be obtained by selling an asset in an orderly disposal. Concerning liabilities, settlement value refers to the undiscounted amount of cash or cash equivalents that are expected to be paid to satisfy the liabilities in the normal course of business;

- present value: concerning assets, this refers to the present discounted value of the future net cash inflows that an asset is expected to generate during the normal course of business. In regard to liabilities, PV refers to the present discounted value of the future net cash outflows that will likely be required to settle the liabilities of the normal course of business; and

- fair value: this refers to the amount at which an asset could be exchanged, or a liability settled, between knowledgeable, willing parties in an arm’s length transaction.

Question

According to the Conceptual Framework (2010), which of the following are the two fundamental qualitative characteristics that make financial information useful?

- Timeliness and understandability.

- Relevance and faithful representation.

- Accrual accounting and going concern.

Solution

The correct answer is B.

The Conceptual Framework (2010) identifies relevance and faithful representation as the two fundamental qualitative characteristics which make financial information useful.

‘Timeliness’ and ‘understandability’ are two of the enhancing qualitative characteristics of information, while ‘accrual accounting’ and ‘going concern’ are the underlying assumptions identified by the Conceptual Framework (2010).

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Sergio Torrico

2021-07-23

Excelente para el FRM 2Escribo esta revisión en español para los hispanohablantes, soy de Bolivia, y utilicé AnalystPrep para dudas y consultas sobre mi preparación para el FRM nivel 2 (lo tomé una sola vez y aprobé muy bien), siempre tuve un soporte claro, directo y rápido, el material sale rápido cuando hay cambios en el temario de GARP, y los ejercicios y exámenes son muy útiles para practicar.

diana

2021-07-17

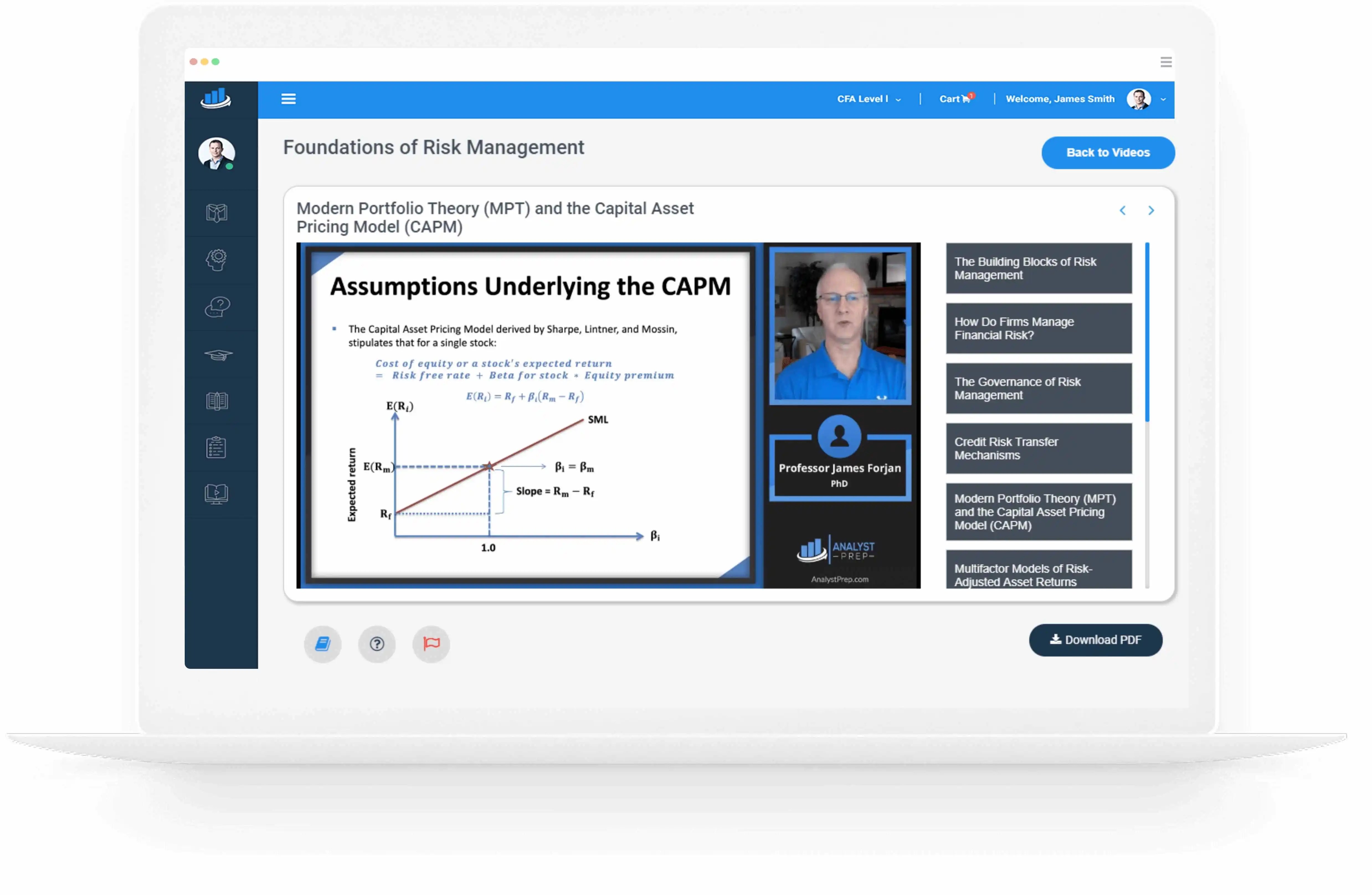

So helpful. I have been using the videos to prepare for the CFA Level II exam. The videos signpost the reading contents, explain the concepts and provide additional context for specific concepts. The fun light-hearted analogies are also a welcome break to some very dry content.I usually watch the videos before going into more in-depth reading and they are a good way to avoid being overwhelmed by the sheer volume of content when you look at the readings.

Kriti Dhawan

2021-07-16

A great curriculum provider. James sir explains the concept so well that rather than memorising it, you tend to intuitively understand and absorb them. Thank you ! Grateful I saw this at the right time for my CFA prep.

nikhil kumar

2021-06-28

Very well explained and gives a great insight about topics in a very short time. Glad to have found Professor Forjan's lectures.

Marwan

2021-06-22

Great support throughout the course by the team, did not feel neglected

Benjamin anonymous

2021-05-10

I loved using AnalystPrep for FRM. QBank is huge, videos are great. Would recommend to a friend

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Trustpilot rating score: 4.5 of 5, based on 69 reviews.

Related Posts